Benefits of Choosing Third-Party Shipping Insurance Over Carrier’s Declared Value Coverage

In 2018, consumers spent $2.98 trillion in global e-commerce, which means billions of packages circulated around the globe. Of those billions, most reached their destination without a hitch. But, inevitably some fell through the cracks, while others arrived to doorsteps damaged or dinged.

According to the United States Postal Service, last year there were over 3 billion pieces of “wasted mail,” which the USPS classifies as parcels that go undeliverable as addressed and fail to list a forward or return address.

While address validation can help prevent the above scenario from happening, it is not a failsafe against damage or theft. It’s estimated that 1-in-10 packages are damaged during the journey from seller to buyer, and “porch pirates” make an increasing impact on a company’s bottom line.

How do I know if I need third-party insurance?

With the majority of carriers offering built-in and add-on insurance coverage, it can feel redundant to elect third-party insurance. And if your package has a declared value of $100 or less, most carriers also automatically include insurance coverage for free. However, there are distinct differences in coverage, which could ultimately mean huge cost savings for your e-commerce business.

Online retailers—particularly those with high-value or high-volume shipments—are the most at risk for loss when it comes to filing insurance claims directly through the carriers. The chance of packages getting lost, stolen, or damaged when you ship on a consistent basis is understandably higher.

In our experience (and with those odds) it’s better to be safe than sorry. So, here are the primary benefits of electing third-party shipping insurance over the carrier’s declared-value coverage:

1. Lower Insurance Rates

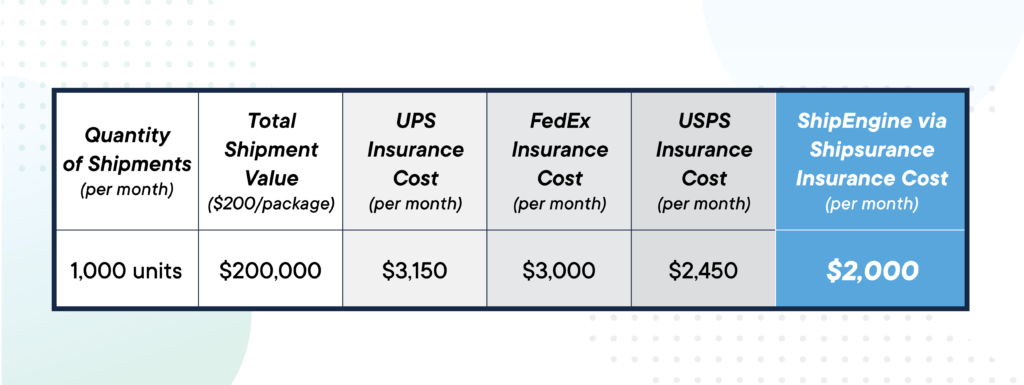

As a ShipEngine user, you have access to additional insurance through Shipsurance for only 1% of your shipment value. With some carriers charging upward of 3%, this represents significant savings. Plus, USPS First Class International shipments are covered under the same great rates.

Carriers, like UPS, sometimes also require insurance minimums—meaning you still have to pay a certain amount to insure your package, even if its declared value is under the threshold. Per package, the difference in cost may seem seem negligible. But the cost savings are clear as soon as you put things in perspective.

For example: Let’s say your business ships out 1,000 items every month, and each package has a declared value of $200. If you declared these values with the carrier, you would end up paying $450-$1,150 more per month than you would by using the built-in, add-on insurance option.

Here’s a chart that directly compares the cost of different insurance options:

2. Broader Coverage = No Surprises

Not only can third-party shipping insurance be more affordable than working through your carrier, it can also be more reliable in terms of coverage. With the Shipsurance coverage offered through ShipEngine, you can have peace of mind knowing that your package is fully insured—whether it’s a small parcel or large freight.

One of the biggest misconceptions about declared-value insurance through carriers is that you are automatically entitled to the $100 worth of free coverage for any package of any value. While this does apply to claims made on packages within the declared value range; if you did not purchase additional insurance and your package was valued at more than $100, your claim would likely not be approved.

Many carriers have also created loopholes in their terms of service that make it easier for them to shirk responsibility for lost and damaged packages that fall into certain categories. This include things like perishable products, loss due to a natural disaster, and/or damage due to insects.

Shipsurance has clearly defined terms that are easy to understand, and it provides ShipEngine users with all-risk coverage. It covers all of the carriers you use, with one unified set of rules. When you need to check if an item you regularly ship is covered, you have access to a simple reference list of the coverage terms and conditions—so there are no surprises!

3. Claims Without the Headache

Everyone has shipping claim horror stories—especially online retailers. This is largely because shipping carriers are in the business of shipping, not insurance claims and adjudications. Carriers are notorious for making the claims process more frustrating than it should be, and unfortunately this can begin to seep into the customer experience.

Whether it’s in your control or not, how the customer experiences every point of the order fulfillment process is a direct reflection on your brand. No one likes losing a package or waiting for a replacement shipment, particularly during the rush of the holiday season. It’s important to make your customer experience as positive and painless as possible. With an easy claims process, you’re able to reduce the headache of arranging your refund and focus more of your attention on nourishing the customer relationship.

With Shipsurance through ShipEngine, you have direct access to a personal claims agent who will assist you throughout the process should you need to file anything. Claims are filed electronically and paid within 5 business days via check, emailed check, or PayPal.

4. Easy Integration

Adding additional insurance to your shipments is as easy as a flip of a switch. With a seamless integration, you’re able to manually add or auto-draft funds directly through your ShipEngine dashboard.

Ready to insure your packages? It’s simple:

- Log in to ShipEngine

- Select “Connections,” then the “Insurance” tab

- Toggle the 3rd-Party Insurance switch ON

- Verify that you’ve read and understand the terms and conditions and follow the on-screen instructions

For more information on how to activate third-party insurance for your shipments, visit ShipEngine’s API documentation.